In the dynamic world of trading, mastering a winning strategy is the key to consistent success. This comprehensive guide will walk you through a powerful strategy designed for QUOTEX, applicable across various brokers and forex pairs. With a focus on a 5-minute candle timeframe and a trade expiry of 5 minutes, this strategy aims to empower traders to navigate the markets effectively. In this article, we will tell you how to win every trade in Quotex, so read the article carefully as we have explained each detail thoroughly.

Strategies for Consistent Win Trade in Quotex

Learn how to make trades on Quotex that are consistently profitable. Discover tried-and-true strategies, risk-reduction tactics, and market intelligence to improve your trading results. Boost your strategy by emphasising consistency and integrating technical and fundamental analysis to make well-informed decisions. Use these strategies to maximise your trading results as you confidently navigate the ever-changing world of Quotex trading.

Strategy #1 Overview

- Market: Applicable to any broker and forex pairs.

- Candle Timeframe: 5 minutes.

- Trade Expiry: 5 minutes.

Buy Trade Strategy

After observing three consecutive green candles, watch for a sequence of one red, one green, and one red candle. Simultaneously, ensure that the Parabolic SAR is positioned below the candle during this pattern. Execute a Buy trade at the opening of the next candle. This strategy leverages the trend reversal indicated by the colour sequence and the Parabolic SAR’s location.

Sell Trade Strategy

For a Sell trade, wait for three consecutive red candles. Following this, look for a sequence of one green, one red, and one green candle. At this juncture, confirm that the Parabolic SAR is situated above the candle. Initiate a selling position at the beginning of the next candle. The strategy capitalizes on the potential reversal signalled by the candle colour sequence and the Parabolic SAR’s positioning.

Key Components of the Strategy

- Candlestick Patterns: Identify and interpret the consecutive candle sequences.

- Parabolic SAR Indicator: Utilize the Parabolic SAR for precise entry points

- Trade Timing: Execute trades promptly at the opening of the next candle.

- Risk Management:Implement sound risk management practices to safeguard your capital.

- Real-world Application: To illustrate the strategy’s efficacy, let’s consider a hypothetical scenario. In a trending market, the Buy and Sell signals provide opportunities to align with the prevalent trend, enhancing the probability of successful trades.

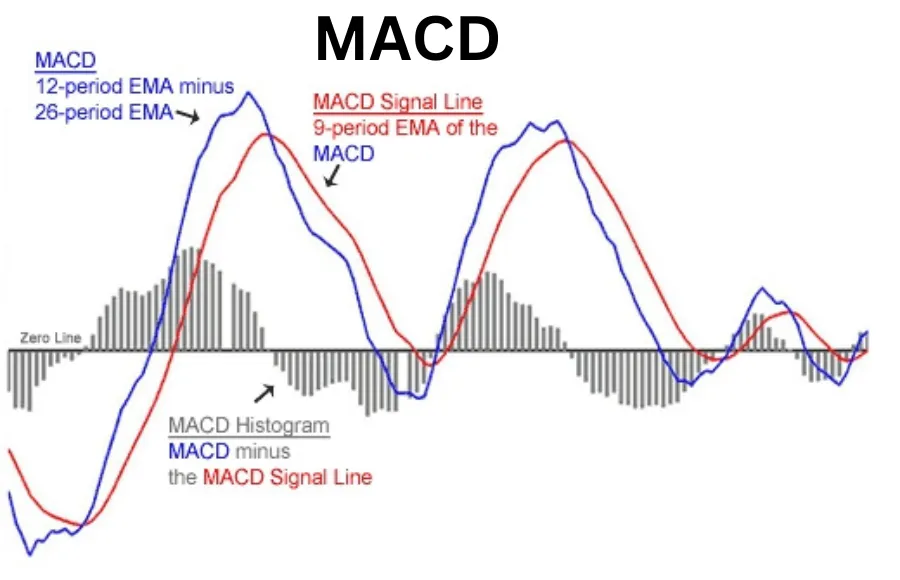

MACD crossover strategy

The Moving Average Convergence Divergence, or MACD, is a powerful and widely used technical indicator in the world of trading. Developed by Gerald Appel in the late 1970s, MACD is designed to identify changes in the strength, direction, momentum, and duration of a trend in a stock’s price. Traders around the globe rely on MACD to make informed decisions and enhance their trading strategies.

Components of MACD

MACD consists of two main components – the MACD line and the Signal line. Additionally, it includes a histogram that represents the difference between these two lines.

- MACD Line: This line is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. The result is the MACD line, providing a view of the short-term trend momentum.

- Signal Line: The Signal line is a 9-period EMA of the MACD line. It smoothens the MACD line, making it easier to identify potential entry or exit points.

- Histogram:The histogram represents the difference between the MACD line and the Signal line. When the MACD line is above the Signal line, the histogram is positive, indicating upward momentum. Conversely, a negative histogram suggests downward momentum.

Setup:

- Use a 5-minute candlestick chart.

- Apply MACD with standard settings (12, 26, 9)

- Identify the MACD line (fast line), Signal line (slow line), and Histogram

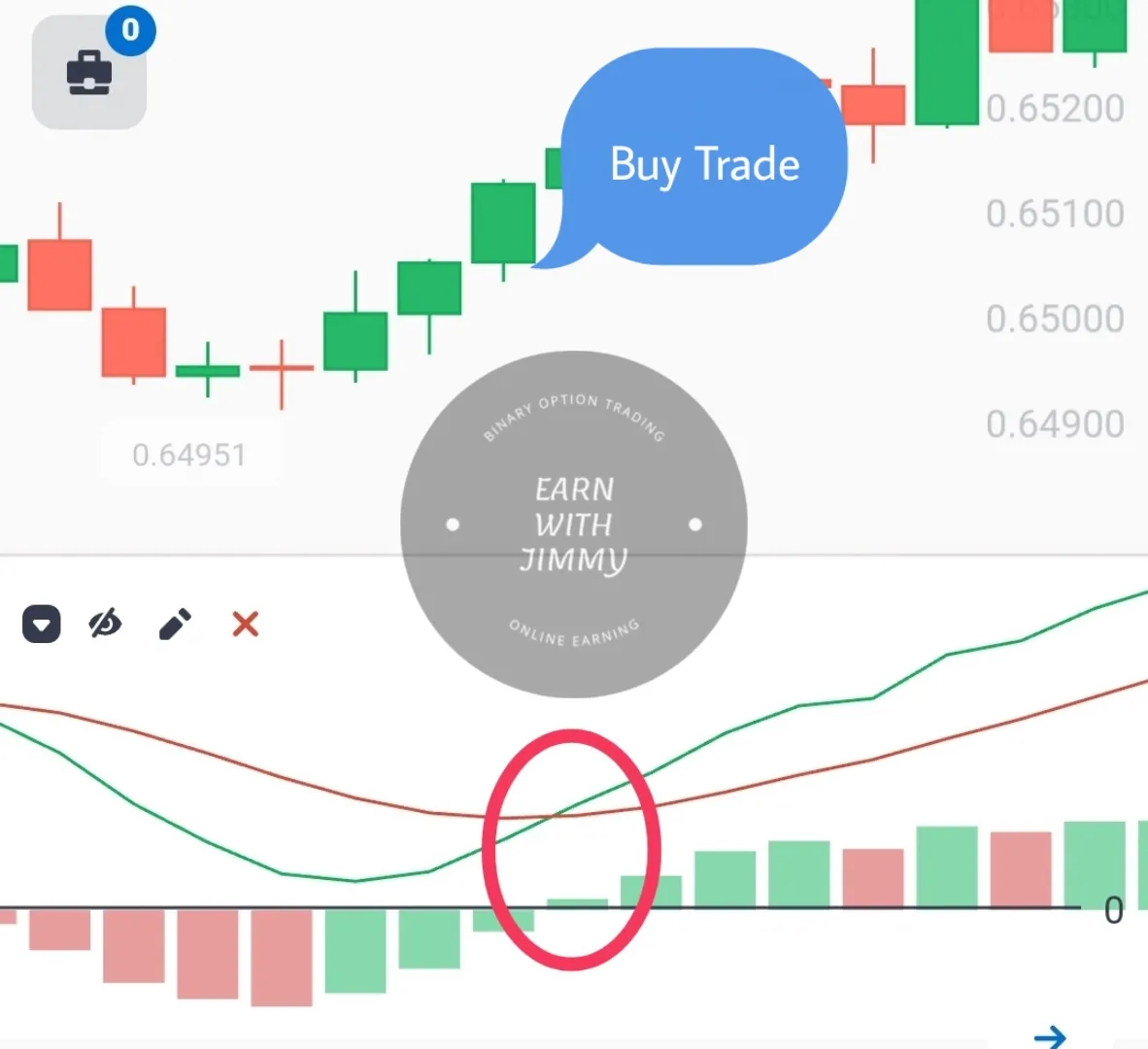

Crossover Conditions

Buy Signal: Enter a Buy trade when the MACD line crosses above the Signal line, and the Histogram turns positive.

Sell Signal: Enter a sell trade when the MACD line crosses below the Signal line, and the Histogram turns negative.

Confirmation

Confirm signals with other technical indicators or trend analysis for increased reliability

Risk Management- Consider using a risk-reward ratio to determine your profit levels.

Timeframe and Trade Duration:

Stick to 5-minute intervals for executing trades. Consider the duration of the trade based on your trading plan or fixed-time constraints.

Remember, trading involves risks, and it’s crucial to test any strategy thoroughly in a simulated environment before using it in real-time trading. Adjust parameters based on your risk tolerance and market conditions. Click here for Free Quotex signals

Tips for Implementation

- Practice in a Demo Environment: Before committing real capital, practice the strategy in a demo account to gain confidence.

- Stay Informed: Keep abreast of market news and events that may impact your chosen forex pairs.

- Adaptability: Markets evolve; be ready to adapt the strategy based on changing conditions.

Approaches for Achieving Consistent Win Trade in Quotex

Education and Research

Knowledge is power in the world of trading. Before diving into the Quotex platform, invest time in learning about financial markets, trading instruments, and technical analysis. Stay informed about global economic events and market trends. Quotex provides educational resources, webinars, and a demo account to help you practice and refine your skils

Advanced Techniques

Explore additional techniques to complement this strategy, such as combining it with Fibonacci retracements, Bollinger Bands, or other technical analysis tools. Understanding how these elements interact can provide a more nuanced and robust trading approach.

Strategic Planning

Develop a well-defined trading plan before entering any trade on Quotex. Clearly outline your financial goals, risk-reward ratios, and criteria for entering and exiting trades. A strategic approach ensures that emotions don’t dictate your decisions and helps you stick to a disciplined trading routine.

Technical Analysis

Utilize technical analysis tools available on Quotex to analyze price charts, identify trends, and spot potential entry and exit points. The use of indicators like Moving Averages, Bollinger Bands, and Relative Strength Index (RSI) can provide valuable insights into market movements.

Fundamental Analysis

Complement technical analysis with fundamental analysis to understand the broader economic factors influencing asset prices. Stay updated on financial news, economic reports, and geopolitical events that can impact the markets. The combination of technical and fundamental analysis can enhance your decision-making process.

Monitoring Market Sentiment

Incorporate an analysis of market sentiment into your strategy. Tools like social media sentiment analysis or news sentiment indicators can provide valuable insights into the broader market outlook.

Continuous Learning

The financial markets are dynamic, and learning should be a continuous process. Stay curious, explore new trading strategies, and adapt to changing market conditions. Quotex’s ongoing educational resources and community forums can be valuable for staying abreast of market developments and learning from other traders’ experiences.

Discipline and Patience

Discipline and patience are virtues in trading. Avoid impulsive decisions and stick to your predefined trading plan. Don’t chase losses or get overly excited during winning streaks. Maintaining a calm and disciplined mindset ensures that emotions don’t interfere with your rational decision-making process.

Related Articles-

- What are the best ways to generate signals on Quotex? Guide 2024

- Free Candlesticks chart patterns pdf

Trading Disclaimer

All content on this platform, including articles, analyses, signals, and other types of content, is solely intended for educational and informational purposes. It is not meant to be a recommendation for any particular trading activity or as financial advice.Before making any financial decisions, people should proceed with caution and diligence as trading and investing in financial markets carry inherent risks. Historical data does not ensure future results, nor is past performance a reliable predictor of future performance.

This platform’s content does not take into account user goals for investments, risk tolerance, or unique financial situations. Before engaging in any trading activity, each person must evaluate their own financial situation and, if necessary, seek professional advice.

The user bears all responsibility and risk for using trading signals, strategies, or any other information available on this platform. Any losses, damages, or other outcomes resulting from the use of or reliance on the provided information are not the responsibility of the platform, its writers, or contributors.

Users are advised to carry out in-depth study, manage their risks, and think about consulting with knowledgeable financial experts. Users should also be conscious of how dynamic financial markets are, and how quickly and unexpectedly conditions can change.Trading is unpredictable, so investors should be ready to lose everything they have invested. It is imperative that people trade sensibly and only with money they can afford to lose.

Users agree to read, understand, and abide by this trading disclaimer by accessing and using this platform. Any financial decisions made by users based on the information provided are not the platform’s responsibility. It is recommended that users maintain current knowledge, pursue ongoing education, and trade with caution. Contact us if you have any queries.

google-site-verification: google91667738fd001cce.htmlConclusion

Mastering the art of winning every trade in Quotex demands a strategic approach and a keen understanding of market dynamics. By following this comprehensive guide and incorporating the outlined strategies, traders can enhance their decision-making and increase the likelihood of success. Remember, disciplined execution and continuous learning are key elements in achieving consistent profitability in the fast-paced world of trading.

FAQ

What is the best winning strategy for Quotex?

Many Quotex traders employ the well liked strategy of trend trading.This trading strategy entails determining the direction of the market trend and following it.Traders using this strategy want to take advantage of the market’s momentum and ride it until the trend begins to show indications of reversal.

How do you win all trades?

Reaching success in every trade is a lofty objective, so it’s critical to take a realistic approach to trading. The inherent uncertainties in financial markets make it impossible to win every trade. A combination of risk management, constant learning, strategic planning, and market condition adaptation are necessary for successful trading. It’s critical to have reasonable expectations, concentrate on steady profitability, and acknowledge that trading will always involve losses. While applying well-thought-out strategies, maintaining discipline, and adapting to market trends are all important for overall success, no strategy can ensure a profitable trade every time.

How do you win every trade in binary

You really need Technical Analysis on your side if you want to win this game. You might need to have your MT4 forex platform available in case your broker underinvests in these tools. Pattern recognition can also be very important in this context, particularly when it comes to candlestick formations.

Is Quotex good for trading?

Due to its extensive feature set and easy-to-use interface, Quotex is a well-liked option for both novice and seasoned traders. With the platform accessible on desktop and mobile devices, traders can access their accounts and execute trades at any time and from any location.

Is there a 100% trading strategy?

The fact that no trading strategy can ensure a 100% profit without risk must be emphasised. There are risks associated with trading in general, and even the most successful traders occasionally suffer losses.

What is the 100 winning strategy in Quotex?

Although there isn’t a single, guaranteed-to-work strategy in Quotex, traders can employ a number of strategies to generate steady profits. Trend following, range trading, and breakout trading are a few well-liked tactics. Finding market trends and positioning oneself in their direction is known as trend following.

What is the quotex strategy?

One common Quotex trading strategy is the one-minute strategy, which entails making trades in response to brief price changes. Although this strategy has the potential to be very profitable, traders must move fast and make decisions in real time.

What is the quotex 5 second strategy?

Due to its distinct trading methodology, the Quotex 5 Second Trading Strategy has drawn a lot of attention lately. This approach is concentrated on quick trades that last no more than five seconds. It seeks to make money by taking advantage of sudden changes in the market and short-term price swings.

What is MACD?

MACD, or Moving Average Convergence Divergence, is a popular technical indicator used in trading to identify changes in the strength, direction, momentum, and duration of a trend in a stock’s price.

How is MACD Calculated?

The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. The result is the MACD line, and a 9-period EMA of the MACD line generates the Signal line.

What Does a MACD Crossover Indicate?

A MACD crossover occurs when the MACD line crosses above or below the Signal line. A bullish crossover (MACD above Signal) suggests a potential uptrend, while a bearish crossover (MACD below Signal) indicates a potential downtrend.

How Can MACD Divergence be Utilized?

MACD divergence occurs when the MACD line moves in the opposite direction of the price chart. Bullish divergence suggests a potential reversal to the upside, while bearish divergence hints at a potential reversal to the downside.

What Role Does the MACD Histogram Play?

The MACD histogram represents the difference between the MACD line and the Signal line. Positive values indicate upward momentum, while negative values suggest downward momentum. Histogram peaks and troughs can signal changes in momentum.

Can I Really Win Every Trade on Quotex?

Achieving consistent success in every trade is challenging and not guaranteed. Trading involves risks, and market dynamics can be unpredictable. Focus on developing effective strategies and risk management rather than expecting to win every trade.

Are There Specific Strategies for Winning Trades on Quotex?

Yes, implementing well-researched strategies, combining technical and fundamental analyses, and staying informed about market trends can enhance your chances of success. However, it’s important to adapt strategies based on changing market conditions.

How Does Risk Management Contribute to Winning Trades?

Effective risk management is crucial for sustainable trading success. Setting appropriate stop-loss orders, diversifying your portfolio, and managing leverage help protect your capital and minimize potential losses.